Future Value Of Ordinary Annuity Calculator

Greels

Mar 25, 2025 · 6 min read

Table of Contents

- Future Value Of Ordinary Annuity Calculator

- Table of Contents

- Future Value of Ordinary Annuity Calculator: A Comprehensive Guide

- Understanding Annuities and Their Future Value

- The Formula Behind the Magic

- Using a Future Value of Ordinary Annuity Calculator: A Step-by-Step Guide

- Practical Applications of the Future Value of Ordinary Annuity Calculator

- 1. Retirement Planning:

- 2. Loan Amortization:

- 3. Saving for Major Purchases:

- 4. Investment Analysis:

- 5. Business Planning:

- Factors Affecting the Accuracy of Calculations

- 1. Interest Rate Fluctuations:

- 2. Inflation:

- 3. Investment Fees:

- 4. Tax Implications:

- Beyond the Calculator: Advanced Considerations

- 1. Irregular Payments:

- 2. Variable Interest Rates:

- 3. Annuities Due:

- 4. Perpetuities:

- Conclusion: Empowering Your Financial Future

- Latest Posts

- Latest Posts

- Related Post

Future Value of Ordinary Annuity Calculator: A Comprehensive Guide

The future value of an ordinary annuity calculator is a powerful financial tool that helps you determine the future worth of a series of equal payments made at the end of each period. Understanding how this calculator works and its applications is crucial for making informed financial decisions, whether you're planning for retirement, saving for a down payment, or assessing investment opportunities. This comprehensive guide will delve deep into the concept, its formula, practical applications, and considerations for accurate calculations.

Understanding Annuities and Their Future Value

An annuity is a series of equal payments or receipts made at fixed intervals over a specified period. An ordinary annuity, specifically, involves payments made at the end of each period. This is in contrast to an annuity due, where payments are made at the beginning of each period. The future value of an annuity is the total value of all these payments, along with their accumulated interest, at a future date.

Imagine you deposit $1000 at the end of each year into a savings account earning 5% annual interest. After five years, you won't simply have $5000 ($1000 x 5). The interest earned on each deposit compounds over time, resulting in a higher future value. This is where the future value of an ordinary annuity calculator comes in handy. It automates the complex calculations, saving you time and effort.

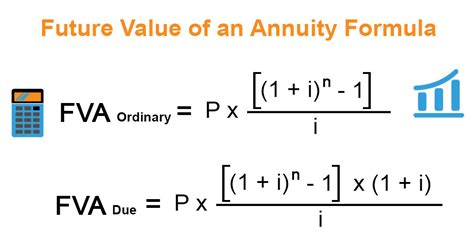

The Formula Behind the Magic

The future value (FV) of an ordinary annuity is calculated using the following formula:

FV = P * [((1 + r)^n - 1) / r]

Where:

- FV = Future Value of the annuity

- P = Periodic payment amount

- r = Interest rate per period (expressed as a decimal)

- n = Number of periods

Let's break down each component:

-

P (Periodic Payment): This is the consistent amount you invest or receive at the end of each period. It could be monthly, quarterly, annually, or any other regular interval.

-

r (Interest Rate): This is the rate of return you earn on your investment per period. It's crucial to ensure this rate aligns with the payment period. For instance, if your annual interest rate is 6%, and your payments are monthly, you need to use the monthly interest rate (6%/12 = 0.5%).

-

n (Number of Periods): This represents the total number of payment periods over the life of the annuity. If you make annual payments for 10 years, n = 10. If you make monthly payments for 5 years, n = 60 (5 years * 12 months/year).

Using a Future Value of Ordinary Annuity Calculator: A Step-by-Step Guide

While you can manually calculate the future value using the formula, a calculator simplifies the process significantly. Most online calculators require you to input the following information:

-

Periodic Payment (PMT): Enter the amount of each payment.

-

Interest Rate (Rate): Input the interest rate per period, ensuring it's consistent with the payment period.

-

Number of Periods (Nper): Enter the total number of payment periods.

-

Future Value (FV): The calculator will compute this for you. You might leave this field blank.

-

Type: Some calculators have a "Type" field. For an ordinary annuity, select 0 (or leave it blank, as most calculators default to ordinary annuities). A value of 1 would indicate an annuity due.

Once you input these values, the calculator will instantly compute the future value of your annuity. This provides a clear picture of your investment's potential growth.

Practical Applications of the Future Value of Ordinary Annuity Calculator

The applications of this calculator are vast and span various financial scenarios:

1. Retirement Planning:

This is arguably the most common use case. By inputting your expected annual savings, interest rate, and retirement timeframe, you can estimate your retirement nest egg. This helps you assess whether your savings plan is on track to meet your retirement goals. You can then adjust your savings amount or investment strategy accordingly.

2. Loan Amortization:

While not directly used to calculate the total loan amount, understanding the future value concept helps in comprehending loan amortization schedules. It helps you visualize the accumulating interest and the eventual payoff of the loan.

3. Saving for Major Purchases:

Planning for significant purchases like a house, car, or education requires careful financial planning. The calculator assists in determining how much you need to save regularly to reach your savings goal within a specific timeframe.

4. Investment Analysis:

Evaluating the potential returns of different investment options is crucial. By comparing the future values of various annuity scenarios, you can make informed decisions about where to allocate your funds.

5. Business Planning:

Businesses use annuities for various purposes, such as setting aside funds for future expansion, equipment replacement, or debt repayment. The calculator aids in forecasting future financial resources.

Factors Affecting the Accuracy of Calculations

Several factors can influence the accuracy of the future value calculations:

1. Interest Rate Fluctuations:

Interest rates are not always constant. Using a fixed interest rate might not accurately reflect future realities. Sensitivity analysis (running calculations with various interest rates) can provide a range of potential outcomes.

2. Inflation:

Inflation erodes the purchasing power of money. While the calculator provides the future value in nominal terms, you might want to adjust it for inflation to get a realistic picture of its real value.

3. Investment Fees:

Many investments involve fees (brokerage fees, management fees, etc.). These fees reduce your overall returns, and neglecting them in your calculations can lead to inaccurate projections.

4. Tax Implications:

Taxes on investment earnings can significantly impact your overall returns. Consider incorporating tax implications into your calculations for a more accurate picture. This usually requires more complex financial modeling.

Beyond the Calculator: Advanced Considerations

While the future value of an ordinary annuity calculator is a valuable tool, remember it's only a starting point. Several advanced concepts and scenarios need consideration:

1. Irregular Payments:

The basic formula assumes equal payments. If your payments vary, you'll need more sophisticated financial modeling techniques.

2. Variable Interest Rates:

For more accurate predictions in volatile market conditions, you would need to employ more advanced financial modeling tools capable of handling variable interest rates.

3. Annuities Due:

As mentioned earlier, annuities due involve payments at the beginning of each period. A separate formula or calculator is needed for these scenarios.

4. Perpetuities:

Perpetuities are annuities that continue indefinitely. They require a different calculation method.

Conclusion: Empowering Your Financial Future

The future value of an ordinary annuity calculator is an invaluable asset for anyone seeking to understand and plan their financial future. By understanding its application, limitations, and the underlying principles, you can effectively utilize this tool to make well-informed decisions regarding savings, investments, and financial planning. Remember that while calculators provide estimates, thorough understanding of the financial concepts and consideration of external factors ensure you make the best choices for your financial well-being.

Latest Posts

Latest Posts

-

How Many Kg Is 25 Lbs

Mar 28, 2025

-

400 Grams Is How Many Ounces

Mar 28, 2025

-

How Many Inches Is 63 Mm

Mar 28, 2025

-

How Fast Is 350 Km Per Hour

Mar 28, 2025

-

How Many Feet Is 126 Inches

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Future Value Of Ordinary Annuity Calculator . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.