Future Value Of Annuity Due Calculator

Greels

Mar 27, 2025 · 6 min read

Table of Contents

Future Value of Annuity Due Calculator: A Comprehensive Guide

The future value of an annuity due calculator is a powerful financial tool that helps individuals and businesses project the future worth of a series of equal payments made at the beginning of each period. Understanding how to use this calculator and interpreting its results is crucial for various financial decisions, from retirement planning to investment analysis. This comprehensive guide delves deep into the concept, its applications, and how to effectively utilize a future value of annuity due calculator.

Understanding Annuities and Annuity Due

Before diving into the intricacies of the calculator, let's clarify the fundamental concepts of annuities and specifically, annuity due.

What is an Annuity?

An annuity is a series of equal payments made at fixed intervals over a specified period. These payments can be made at the beginning or end of each period, leading to two types of annuities:

- Ordinary Annuity: Payments are made at the end of each period.

- Annuity Due: Payments are made at the beginning of each period.

Why is Annuity Due Different?

The key difference lies in the timing of payments. In an annuity due, each payment earns interest for one extra period compared to an ordinary annuity. This seemingly small detail significantly impacts the future value. Because each payment has an extra period to accumulate interest, the future value of an annuity due is always higher than that of an ordinary annuity with the same parameters.

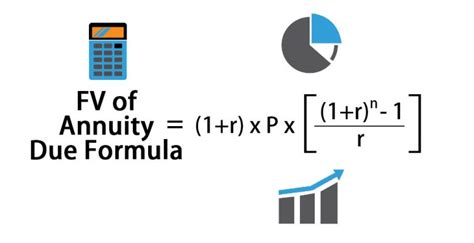

The Formula Behind the Calculator

The future value (FV) of an annuity due is calculated using the following formula:

FV = P * [((1 + r)^n - 1) / r] * (1 + r)

Where:

- FV: Future Value of the annuity due

- P: Periodic payment amount

- r: Interest rate per period (expressed as a decimal)

- n: Number of periods

Let's break down the formula:

- ((1 + r)^n - 1) / r: This portion calculates the future value of a regular annuity (payments at the end of each period).

- (1 + r): This factor accounts for the extra period of interest earned because payments are made at the beginning of each period. This is what distinguishes the annuity due formula from the ordinary annuity formula.

Applications of the Future Value of Annuity Due Calculator

The future value of annuity due calculator has a broad range of applications across various financial scenarios:

1. Retirement Planning:

Perhaps the most common application is retirement planning. Many retirement plans, including 401(k)s and pensions, involve regular contributions made at the beginning of each period (e.g., monthly or quarterly). Using the calculator, individuals can project the future value of their retirement savings based on their contribution amount, the investment's rate of return, and their savings timeline. This helps them assess whether they are on track to achieve their retirement goals.

2. Investment Analysis:

The calculator is invaluable for evaluating different investment options. For instance, comparing two investment strategies with equal periodic contributions but varying interest rates can reveal significant differences in their future values. This allows for informed decision-making by highlighting which strategy provides better returns.

3. Loan Amortization:

While not as directly applicable as in retirement planning or investment analysis, the calculator can still provide insights into loan amortization. By adjusting the inputs to represent loan repayments, the calculator can project the total amount repaid over the loan's term, demonstrating the effects of interest accumulation.

4. Leasing Agreements:

Lease payments are often structured as annuity dues. Using the calculator, individuals and businesses can determine the future value of lease payments, factoring in the interest rate and lease term. This analysis helps in evaluating the overall cost of leasing versus purchasing.

5. Savings Goals:

The calculator helps individuals assess how much they need to save periodically to reach a specific savings goal, such as a down payment on a house or funding a child's education. By inputting the desired future value and the interest rate, the calculator can determine the required periodic payment amount.

Using a Future Value of Annuity Due Calculator: A Step-by-Step Guide

While the formula is crucial for understanding the underlying mechanics, utilizing a calculator simplifies the process significantly. Most online calculators require you to input the following:

-

Periodic Payment (P): Enter the amount of each payment. This should be a consistent amount throughout the annuity's lifespan.

-

Interest Rate (r): Enter the interest rate per period. Ensure that the interest rate aligns with the payment frequency (e.g., if payments are monthly, the interest rate should be the monthly rate). If the interest rate is given as an annual rate, divide it by the number of periods per year to get the periodic rate.

-

Number of Periods (n): Enter the total number of payment periods. This is the length of the annuity expressed in the same units as the interest rate (e.g., months, years).

Interpreting the Results and Making Informed Decisions

Once you input the values and calculate the future value, carefully analyze the results. Consider the following factors:

-

Sensitivity Analysis: Conduct a sensitivity analysis by varying the input values (interest rate, payment amount, or number of periods) to observe their impact on the future value. This helps understand the risks and uncertainties associated with your financial projections.

-

Inflation: Remember that the future value calculated is in nominal terms. To get a realistic picture of your future purchasing power, adjust the future value for inflation using an appropriate inflation rate. This will give you the real future value.

-

Real vs. Nominal Rates: Be aware of the distinction between real and nominal interest rates. Nominal rates are the stated rates, while real rates account for inflation. Using real rates in the calculator provides a more accurate projection of future purchasing power.

Advanced Considerations and Limitations

-

Variable Interest Rates: Most calculators assume a constant interest rate throughout the annuity's life. In reality, interest rates fluctuate. To account for this, you might need to use more sophisticated financial modeling techniques or employ a calculator that allows for variable interest rates.

-

Taxes and Fees: The calculations generally don't factor in taxes or investment fees. These factors will reduce the actual future value. Remember to incorporate these costs for a more accurate assessment.

-

Risk Tolerance: The calculations are based on the assumed interest rate. Higher interest rates imply higher risk. Adjust your assumptions based on your risk tolerance.

Conclusion: Mastering the Future Value of Annuity Due Calculator

The future value of annuity due calculator is an essential tool for making informed financial decisions. By understanding its underlying principles, mastering its usage, and interpreting the results critically, individuals and businesses can effectively plan for the future, evaluate investment opportunities, and achieve their financial goals. Remember to always consider the limitations and potential complexities before relying solely on calculator results. Consult with a financial advisor if you need personalized guidance for your specific financial situation.

Latest Posts

Latest Posts

-

What Is 30 Mm In Inches

Mar 30, 2025

-

1 85 M In Inches And Feet

Mar 30, 2025

-

Cuanto Son 144 Libras En Kilos

Mar 30, 2025

-

What Is 81 Days From Today

Mar 30, 2025

-

How Many Miles Is 130 Kilometers

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about Future Value Of Annuity Due Calculator . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.